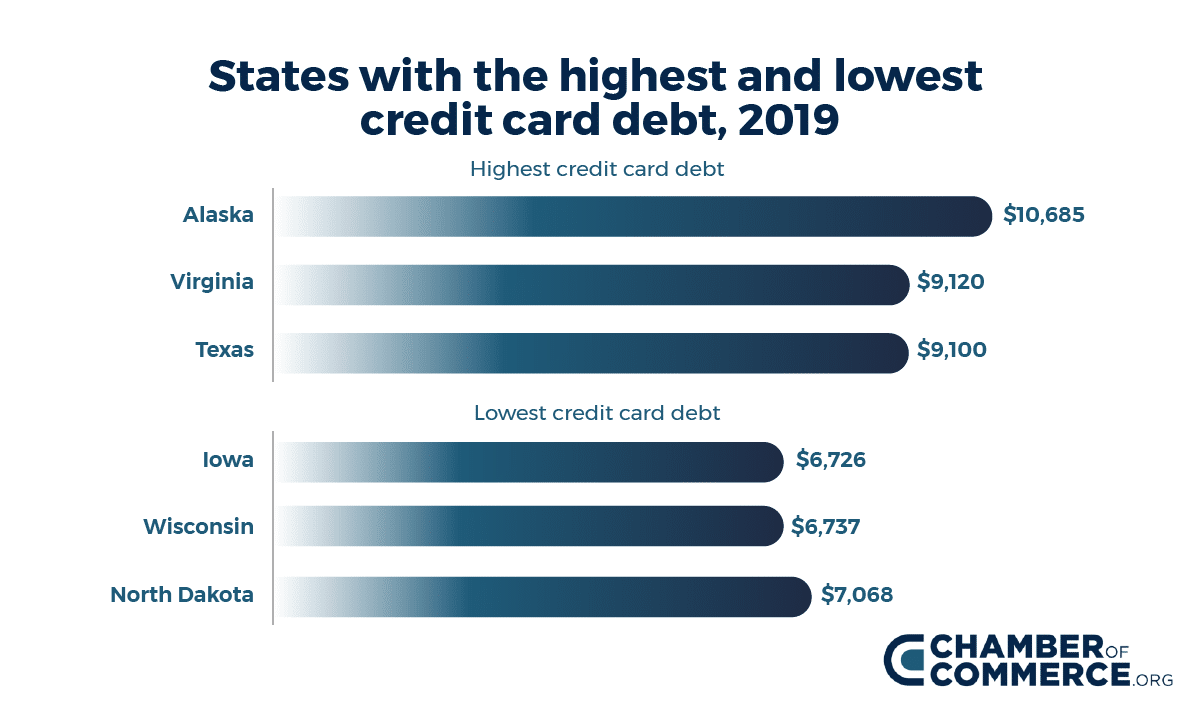

dos. Keep the Balance Lowest

The amount you borrowed from along with takes on a big part in the choosing your credit score. This new smaller you owe, particularly in review into matter you could acquire, the greater their get. Even if you provides a leading maximum on your own credit card, maintain your harmony well less than it. It is easier to pay back your financial situation when you usually do not obtain also far. you look more reliable so you can loan providers if for example the balance sit lower.

Although you must have borrowing from the bank profile to establish a card records and commence building your score, you’ll have an excessive amount of the best thing. Brand new borrowing has an effect on their rating, each day your discover an alternate account, their get drops a bit. If you big date to the shopping center and open multiple the latest shop handmade cards in a day, that can have a distinguished influence on your own borrowing from the bank. Opening multiple the playing cards simultaneously would be a purple flag to have a loan provider. They could look at the this new profile and you will question if you are feeling financial difficulties, which may allow tricky on how best to pay-off a unique mortgage.

While you are in the process of obtaining home financing, it’s critical your stop beginning new profile, no less than if you don’t has actually final recognition on home loan and you will possess signed on your house. Beginning an alternative mastercard or taking out an auto loan while you are your own financial is within the underwriting procedure can also be seem like an alert bell to your bank, causing them to force stop toward procedures.

4. Require Borrowing limit Develops

Their borrowing from the bank application ratio has an effect on your credit rating. The newest ratio compares how much cash credit available against. simply how much you have used. Including, for those who have a credit card having a $1,000 limitation and have a peek at this link you may a balance off $100, your own borrowing from the bank use ratio are 10%. The lower the ratio, the better for the borrowing. Preserving your balances low is one way to help keep your ratio reduced. Another way will be to raise your borrowing limit. Including, you could inquire the financing bank to increase their $step one,000 limitation so you’re able to $dos,000.

Credit card issuers is willing to improve your limitation from inside the numerous circumstances. If you have a reputation expenses promptly, the company you will view you since the a lower-exposure debtor and you will agree to increase your limitation. An improve on the credit history or an increase in their family earnings can also convince a credit card business that you’re a good candidate to have a limit increase.

5. Remain Membership Discover

Brand new offered your credit history is actually, the higher it appears so you’re able to loan providers. A person with good 20-year record features a lot more to exhibit than just some one with a beneficial four-year record. If possible, keep borrowing from the bank accounts available to maximize the duration of their records. Eg, if you have credit cards which you no further use, it’s still smart to contain the membership discover.

One more reason to keep credit card membership unlock would be the fact performing thus helps the borrowing from the bank usage proportion. For those who have three handmade cards that each possess an excellent $5,000 limitation, their readily available credit is $fifteen,000. Romantic one particular cards, as well as your available borrowing falls to help you $ten,000.

six. Keep an eye on Their Borrowing

Men tends to make errors, for instance the credit reporting agencies. Whether you plan on the making an application for a mortgage in the near future or perhaps in the fresh faraway coming, it is best to store a virtually eyes on your credit file, to help you place and you may boost one problems that arise. You’ll be able to errors were incorrectly advertised payments, membership which do not fall into you and outdated suggestions. When you see an error on the declaration, you can allow borrowing from the bank agency learn, and it’ll do it to correct they.