Improve relocate to the future of Home loans having an effective customised interest, including a much deeper write off as high as step 1% once you control your money well. Southern Africa, there is certainly the potential to store a collaborative R12 mil a-year when you look at the notice.

Finding Lender is thrilled to create your Southern Africa’s basic and you may merely shared-value home loan. Regardless if you are an initial-go out customer otherwise seeking to revision, you’ll enjoy a complete environment of masters and you will customize-generated provider within a few minutes on your banking software. Also, spend to just one% faster on your own customised mortgage interest, when you control your money really.

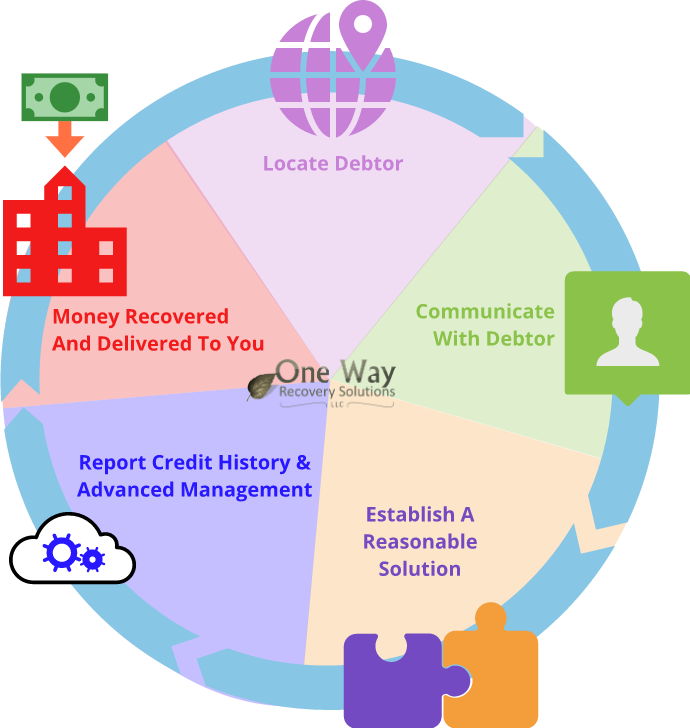

Knowledge Financial Home loans is the current shared-worthy of providing from Finding Financial. They rewards you having an industry-basic reduction of doing step one% of an already personalised rate of interest having handling your money really and you can securing your biggest asset.

With a breakthrough Lender Mortgage, you might get an alternate mortgage, option your current home loan to help you Breakthrough Bank, otherwise refinance a premium-right up property. All of the mortgage brokers, which have Finding Bank be eligible for the rate dismiss.

A little more about Discovery Lender Mortgage brokers

Read more regarding Common-worthy of Financial observe how dealing with your bank account well creates less chance and much more really worth to own Finding Financial as well as you.

- That have Development Financial Home loans , it is certain regarding a precise chance-oriented interest.

- Finding Bank also offers lenders up to 100% of worth of characteristics, having personalised interest rates over a range of cost terms and conditions upwards so you’re able to 30 years.

- You’re going to get good personalised house-mortgage initial render in five full minutes, and you may an entirely digital app techniques in our prize-effective Breakthrough Financial app.

Hylton Kallner, Ceo of Advancement Financial, claims, “This might be a very forecast milestone for all availableloan.net/installment-loans-pa/lawrence/ of us even as we discover new digital doors to the mortgage brokers environment. People looking to purchase a different family or trying to change, will enjoy an entire ecosystem of pros and you may modify-generated qualities regarding Knowledge Lender software. Our very own readers have comprehensive resident support, and that includes the house finance that have security circumstances for their land and you may family unit members, accessibility most investment of your time options, and various rewards.”

That’s right, Advancement Financial has the benefit of competitive, personalised rates of interest according to individual chance profile. After that, due to the created Mutual-value Banking design, we let you subsequent lower your interest of the right up to one%. It’s all ideal for your financial well being. What is needed, will be to manage your currency well which have Energies Money and securing your property mortgage and you may house with the appropriate insurance policies points Discovery has the benefit of. So, you might secure an excellent ically eradicate desire costs of the managing your bank account really to save over the lasting.

Just what that it dynamic rate of interest saving opportinity for SA

Through this mutual-really worth approach, the current Development Financial number of customers helps you to save doing R2.8 billion into the appeal costs on their newest funds. With similar model, Southern area Africans will save you around R12.dos million a year in the attention.

Kallner claims, “We think motivated to replace the landscaping out of homeownership. The initial nature out-of lenders mode consumer and resource risk typically get rid of throughout the years. With a high will cost you adversely impacting repricing otherwise switching to a separate financial, as a result, you to a projected 60% in our clients are overpaying to their present mortgage brokers today. The clear answer is not just a good shortly after-from borrowing from the bank reassessment, however, a person managed vibrant interest rate you to definitely adjusts predicated on real-date changes in financial behaviour.”

This new Development Financial Mortgage unlocks access to a complete home ecosystem

Once the an advancement Bank client, you could potentially start a mortgage app from Advancement Financial app within a few minutes. Toward financial software, you could potentially:

- Get an initial render into the 5 minutes.

- See to 100% money for your house.

- Get a hold of repayments terms and conditions around 30 years.

- Implement that have up to three co-candidates.

- Save very well thread lawyer fees.

- Unlock an extra doing step 1% regarding their rate of interest and other rewards.

You’re going to get a devoted representative to manage the application and you will publication your through the techniques, and you might cut back to help you fifty% into the bond attorney fees. Including, once the an individual, you might take pleasure in home loan protection to guard the house with full strengthening and you may information insurance rates, effortlessly triggered within your financial app.