Tatom Lending are a good Dallas mortgage broker which have an emphasis for the teaching, strengthening, and you will securing people, financial borrowers, and homebuyers

In lieu of Your Bank, Home loans Gain access to Of a lot Lenders In place of your own lender one only has entry to their mortgage cost, Dallas lenders have access to various lenders. Of numerous lenders work at different varieties of borrowers. These types of some other borrowers start around large credit history individuals, very first time homebuyers, poor credit, FHA finance and you may Veteran loans among others. This means lenders can be research rates for you and examine pricing from a number of lenders. For people who go to your lender while usually do not fit the brand new reputation out-of exactly what your financial institutions benefits was, you are going to most likely rating a rate and you can term that’s not advantageous for your requirements. But a mortgage broker will find the lender one best suits their weaknesses and strengths. Which causes getting the most useful speed and terms, while the a Dallas large financial company discovers the financial institution that is most useful suited to your needs.

They understand the business Better Most of the time, your own banker works closely with various types of money. While this can benefit your for many who need a niche sort of off financing. If you’d like a mortgage, an effective Dallas large financial company could be most useful suited to your circumstances. This is really important since there are of several activities one dictate interest rates and you may charge away from a home loan. This type of things include your credit rating, downpayment, mortgage to help you value, earnings, debt ratio, loan amount along with your expenses patterns an such like. A skilled large financial company will reveal making your own financing more appealing so you’re able to lenders.

Lenders be a little more Available Banker’s manage many different types away from financing and you can consumers. Bankers manage retail loans, personal loans, commercial financing and you will home-based money among others. More often than not it focus on the higher currency industrial readers. Lenders likewise understand how stressful experiencing the mortgage application process is going to be. Particularly when specific unanticipated difficulties occur. After you work at a large financial company, he or she is here for your requirements and are usually a lot more availab0le than just the banker alternatives. A beneficial Dallas mortgage broker has actually more time discover that loan that is true to you along with your specific requires. Mortgage brokers know how to overcome some of the hurdles you to built underwriters and even more importantly, they have the full time to talk about to you how to beat them. Which have a large financial company that is readily available when you need all of them can be extremely of use.

Like, when you have enough personal credit card debt, this may connect personal loans Chicago IL no credit check with your own interest levels, because your financial will determine which you have a top exposure away from being unable to build money

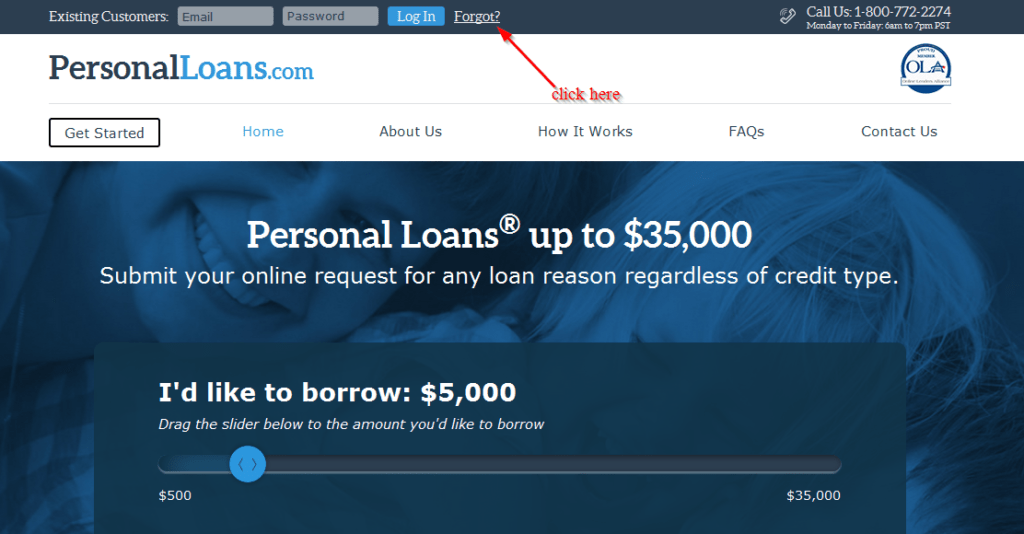

Mortgage brokers Will allow you to Result in the Right Decision Home loans allows you to find the best it is possible to mortgage based on their financial predicament. Both, finding the best home loan for the situation can be a great issue or even understand how to start. But here’s what a beneficial Dallas mortgage broker do. This is certainly their job. They could support you in finding aside what type of financing form of (changeable. Repaired, resource, brief otherwise long term etc.) and you will exactly what the costs could be, in order to create the best choice about on precisely how to go ahead next.

You can expect truthful methods to the fresh credit processes into the maximum respect getting ethics and you will our customer’s financial needs. While we run of numerous general banking institutions and you will credit institutions; we do not work for a lender. We meet your needs; and you will the lifetime utilizes your prosperity. We believe that the regards to the loan are merely as the very important while the speed, which explains why we likewise have all of our clients having choices and you may work at outlined data in order to finest understand the effect out-of your choice.