Records Requirements for a great DACA Mortgage

The degree of documentation and documentation requirements having a beneficial DACA financial is largely just like compared to a frequent antique loan. Are an excellent DACA receiver doesn’t mean you must fill out more data files due to your home-based condition.

Just like the standards to have a good DACA home loan can vary from one financial to another, very lenders will usually require after the files to verify the residency and you can employment reputation:

- Your A career Consent File or EAD card granted by the You.S. Citizenship and Immigration Characteristics (USCIS) and may have a great C33 group.

- The prior EAD notes that may has expired. This will reveal lenders that the USCIS has been stimulating their house status.

- Your own Societal Protection Number or Individual Taxpayer Identity Number.

Most loan providers would want to select a 2-12 months work record to get you entitled to a mortgage. But not, self-operating DACA owners might still qualify for a home loan as the much time because they meet with the most other standards required by the financial institution.

Be sure to exhibit evidence you have enough money to cover the fresh new month-to-month financial amortizations and money to your deposit or other costs with the mortgage. Loan providers may want to look at your earnings records instance spend stubs, W-2 comments, federal taxation production, or any other data files you to definitely establish your income. You could bring a duplicate of your current savings account comments over the past a few months to ensure you have enough currency to purchase out-of-wallet costs associated with to get property.

Ways to get an excellent DACA Financial

Conventional DACA mortgages promote options having Dreamers getting property in the usa. You will need to meet with the necessary criteria set by lenders and you will continue to renew the DACA updates to help you be considered.

When you are prepared to get a home and would like to get household purchase funded because of the an effective DACA home loan, step one is to get a lender that provides DACA lenders. It is vital to inquire the financial institution if they have a tendency to agree borrowers that have DACA updates since the not absolutely all banking institutions will accept programs of DACA receiver. This will help you end potential trouble afterwards.

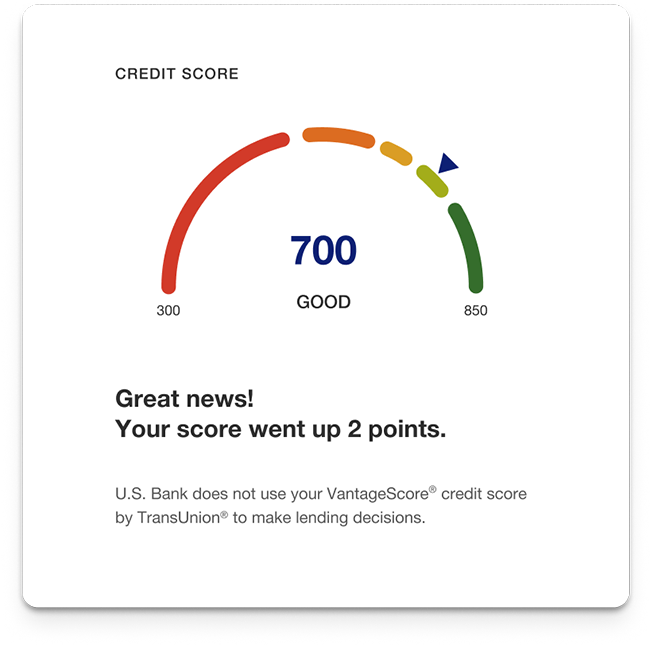

To pre-qualify, the lender use points like your credit rating, earnings, plus most other latest loans. This will give you Rocky Ford cash advance a sense of the options available and you will just how much home you can afford purchasing.

When you score a beneficial pre-certification, you could start running the loan software. It’s important to prepare yourself money to suit your downpayment and you will closing costs. Occasionally, you are permitted to explore present finance to fund most of the otherwise section of your down-payment and settlement costs. The individuals that are entitled to offer current finance is household members, dependents, people, and you can partners or lovers. The person providing the current finance may need to manage both you and your bank to follow the prerequisites.

Earliest DACA Financial Requirements

Is actually a good DACA home loan distinct from a keen ITIN financing? ITIN loans are formulated especially for low citizens that living and dealing in america as well as have an enthusiastic ITIN cards. There are ITIN loan providers just who bring unique applications for those someone. They are diverse from DACA mortgage loans given that that have DACA you are perhaps not a citizen nevertheless still will also have a personal cover matter.

Is an effective DACA recipient rating a keen FHA mortgage? You’ll be able for somebody that have DACA reputation locate an enthusiastic FHA mortgage if they meet with the particular criteria and in case the financial institution will accept brand new DACA reputation.