Alexis Conran offers extremely important tricks for first time people

Britain’s most significant strengthening neighborhood should be to provide earliest-time customers loans as high as six moments the income having a maximum profile out of ?750,000, from inside the a primary to possess a primary financial.

The fresh income enables a couple getting ?50,000 among them the chance to obtain ?3 hundred,000, that is some ?75,000 more in earlier times.

not, people to your a high joint earnings with a 10 percent put will discover the most he’s allowed to borrow rise regarding most recent limitation away from ?five-hundred,000 to ?750,000.

The offer out-of Across the country paydayloanalabama.com/valley-grande/ strongly recommend it is keen to grab good higher share of basic-day consumer business for the a move that’s probably result in anybody else to follow match and perhaps discharge a great deal larger money within the reference to paycheck.

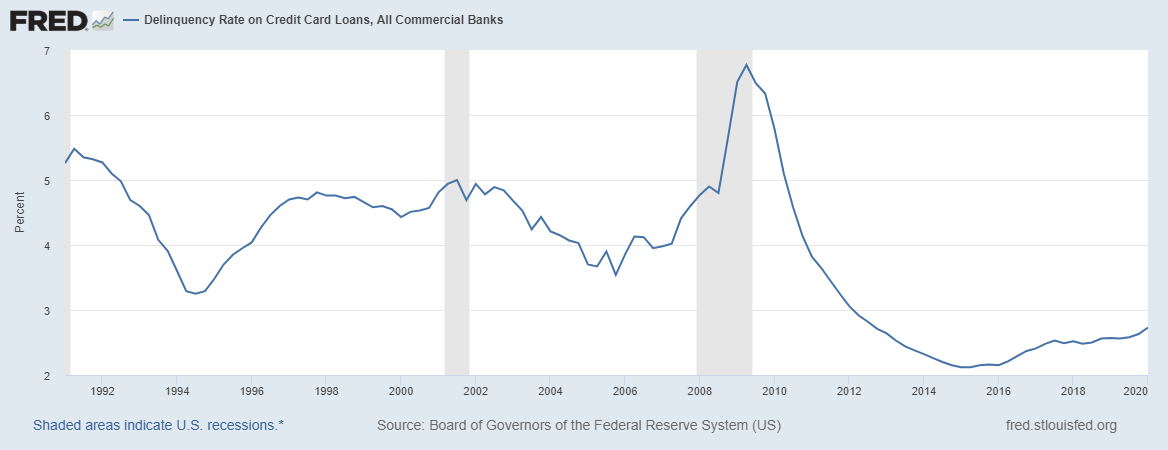

But not, moves of the banking companies and strengthening communities to provide super finance keeps put its own problems prior to now. Like, they triggered a home speed ripple until the economic freeze of 2008 that leftover consumers for the bad equity if this burst.

Nationwide, that’s offering the profit in brand name Permitting Give mortgage loans, said they will certainly wade real time so you’re able to the fresh individuals out of the next day.

The new organisation told you the latest mortgages is geared towards supporting the government’s housing ambitions and you will shows the value of becoming part of good modern shared that is focus on for the advantageous asset of the users.

Based on Uk Money studies, to 5 % of all the home get financing was in fact more than ?five-hundred,000 regarding 6 months to . Together with figure are an even higher twenty-two per cent inside the London area.

Debbie Crosbie, Nationwide’s Leader, said: Permitting Give have offered to forty,000 somebody onto the property steps just like the i launched it about three years ago.

We wish to do more and try boosting this new system so you can half a dozen times earnings and you can improving the limitation loan size. That it, near to the latest price cuts, further improves all of our business-best position and you can indicates that, as among the UK’s biggest loan providers, All over the country continues to set first-big date consumers earliest.

Nationwide’s Home Rates Index3 suggests the average first-date buyer assets rate in britain is actually ?226,794, although not, this may vary commonly all over the country.

Enabling Hand has ended up for example helpful in the new External South-east, where the average first-time client domestic rate really stands within ?262,504, and you may where use regarding Helping Hands might have been higher.

Nationwide responded to concerns you to definitely young adults usually takes for the loans they can not afford to shell out, claiming for each and every application will remain at the mercy of strong underwriting checks, together with complete evaluation regarding credit score and additional borrowing from the bank commitments.

David Hollingworth, Representative Director, Telecommunications from the L&C Mortgages, said: Permitting Give has been a front runner into the broadening the number regarding choice accessible to earliest-time people whom continue steadily to have a problem with affordability.

Building a sufficient deposit is tough sufficient especially when the new offered home loan borrowing try capped, and you can costs will always be high. Beginning the potential for higher borrowing from the bank numbers for the right consumers can assist target the newest dual challenges one first-date buyers deal with along side Uk. Utilising the established sense and you will popularity of Helping Give to help expand enhance the restriction numerous will offer a great deal more prospective earliest-day people new pledge that control could become a reality.

Popular

We use your signal-as much as render articles in ways you decided to in order to boost the knowledge of your. This may are advertising of us and you will third functions based on all of our insights. You might unsubscribe when. Realize our very own Online privacy policy

Matt Smith, Rightmove’s Home loan Professional, said: This package from strategies is actually an encouraging growth in the initial-big date consumer business, as it really address contact information a primary burden that many deal with from inside the being able to use adequate to just take that essential first step into homes steps.

It is likely to be eg useful in components eg London area plus the South east in which house costs are high, and you can the average selling price off a property is much more than just five times the typical paycheck regarding two people.

“We have been showing affordability just like the a button material up against first-big date customers this season and requiring innovations that can help defeat this type of pressures within the an accountable means. I welcome it move and you will pledge this is basically the start of the a special and you may expidited revolution away from help getting first-date people.

Brand new timing of the announcement was invited by many people earliest-time buyers, given that we’re watching a far more effective housing marketplace than within this time a year ago, with visitors request growing on the generally active Fall season.