I certainly am not planning avoid probably meetings, info meals, even more groups and you will seminars to repay my personal 180K cuatro% education loan – a two season stagnation you are going to indicate a good 4 12 months seeking get caught up

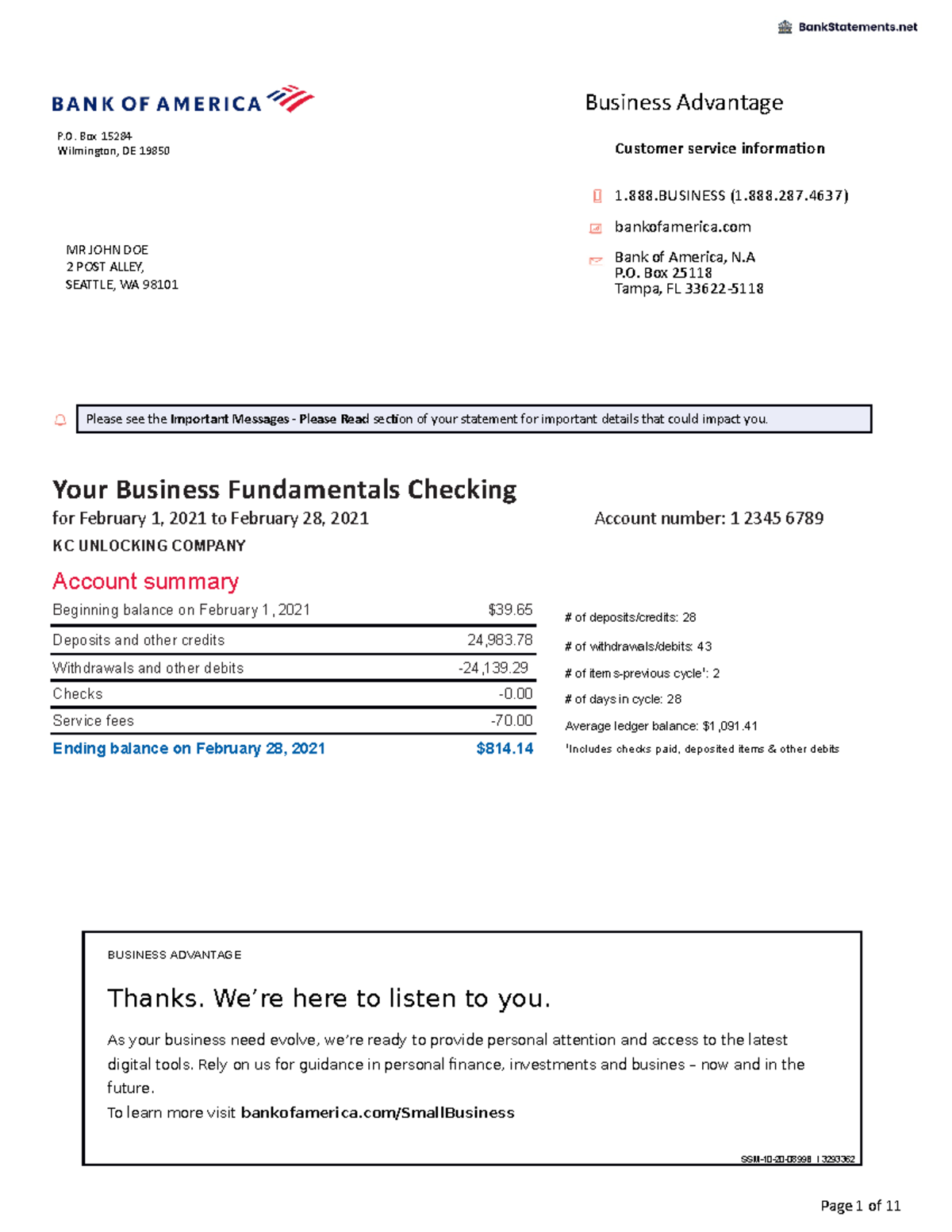

We removed $60k in 2.5 years, and you can increased my online value in order to $80k. Thus i entirely agree that it can be done for individuals who simply cut out the enjoyable articles because you only need to clear they Today earlier becomes uncontrollable.

Fabulously Bankrupt in the city Simply a great girl looking a balance ranging from being a great Shopaholic and you may a beneficial Saver…

I’ve zero wish to shell out away from my personal pupil financial obligation in the a hurry. It is at the 0% (I am an one half-day beginner), just in case I am not at school, at about 4%. I might rather afford the $125/mo and invest in my personal old age, cut to possess an enthusiastic efund, plus save yourself to own travel than just cure much at my student loans. I just cannot become it’s an encumbrance, but alternatively a costs. Such as for instance insurance rates or something. We pay it, however it does not lbs me personally off.

But other than my personal most recent loans, I experienced on $6000 out-of individual financing from the a high changeable speed that we paid off As soon as possible.ادامه خواندن