Structuring & Giving Lease-To-Very own Sale

Future property owners trying to find their next residence can sometimes order it toward old-fashioned investment plan out-of a mortgage and you may a down payment. But what if you have a prospective buyer who can not get a mortgage through its income otherwise credit rating? Otherwise what if you are the Arkansas direct lender installment loans consumer, and you simply don’t want to pay thousands off bucks for the attention repayments into lender? Because works out, there’s nonetheless an effective way to purchase otherwise sell a house without being the lending company inside. Just how to Framework and provide Rent-to-Own house Revenue

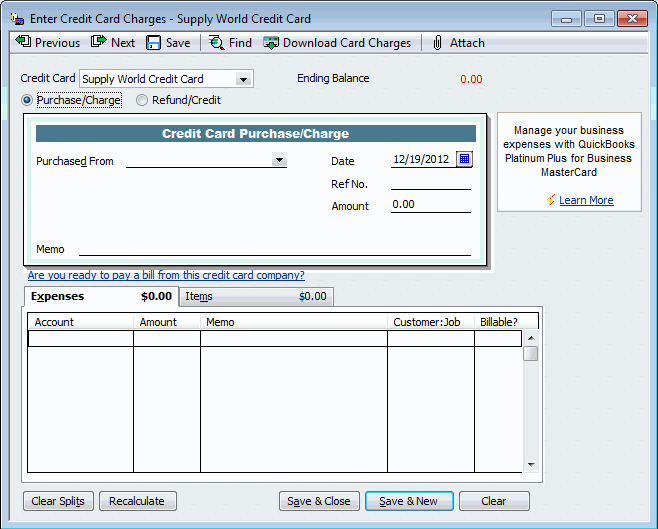

- Draft a cost Contract

- Would a rental Arrangement

- Incorporate Lease to help you Dominant

That erican people that nearly universally is actually taught to believe one deposit and you can a mortgage is the only way so you can purchase a home.

The conventional Home loan Approach

A resident identifies they want to offer their house. This supplier solicits the help of a realtor otherwise Real estate professional, who’ll record the house in the industry and you may create the fresh standard energy to help make the home lookup presentable it normally feel demonstrated to prospective buyers.ادامه خواندن