Finest HELOC and you may Family Security Loan companies when you look at the Texas

Mortgaged Tx homeowners watched the common guarantee obtain away from $54,000 season-over-season, centered on CoreLogic’s Resident Security Wisdom report to own Q1 out of 2022. Some Colorado metro areas, for instance Iowa title loans the Austin-Round Rock and you will Sherman-Denison area portion, spotted yearly price increases as high as 25.8% inside later 2021.

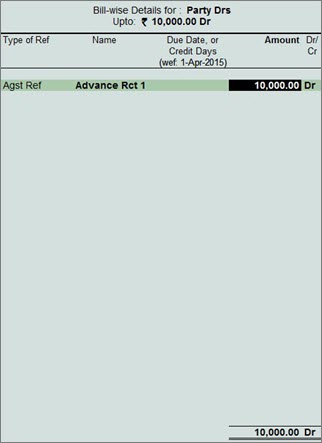

Very house equity loan providers determine how a lot of a loan they is also expand based on the guarantee you have of your house, putting home owners inside a good position so you can make use of family security for money which have often a property collateral financing otherwise household equity personal line of credit (HELOC). Lent domestic guarantee financing are used for any type of mission, such as for example debt consolidation, renovations, otherwise college tuition.

That being said, not all family guarantee mortgage and you will HELOC lenders are designed equal, and you’ll wish to know things to pick of trying for the best HELOC otherwise domestic equity bank for you.

- No software fee or annual payment

- Professionals for brand new and you can existing Freeze Financial people

- Small, 15-second software process

- Limited in Tx

- Need manage a merchant account to use

Headquartered inside San Antonio, Colorado, Frost Bank’s goods are only available so you’re able to Tx citizens. Among the circumstances given try domestic collateral financing, HELOCs, and appeal-merely HELOCs. If you are not sure what type of those products is best to you personally, this new Freeze Bank webpages provides that loan device options device so you can make it easier to consider carefully your options. House collateral finance have mortgage levels of $2,100 or more, while you are HELOCs come with range levels of $8,100 or more.

Frost Lender doesn’t need an application percentage otherwise a yearly percentage.ادامه خواندن