Vendors Stopped Regarding Workouts Mortgage Backup Clause

Plans out of revenue fundamentally consist of a laundry list of contingencies hence should be came across through to the payment day. Most, if not completely, ones contingencies allow the customer to flee off an otherwise bad a property exchange.

From inside the Watson v. Gerace, the us Courtroom from Is attractive to the 3rd Routine recently avoided residents of exploiting home financing contingency term present in an enthusiastic agreement from income.

J. Scott Watson and you will Laura Watson, exactly who had the second floor flat during the an effective duplex during the Ocean Town, Nj-new jersey, conducted a composed arrangement to offer the apartment to Joseph and Donna Gerace to possess $665,000.

The newest get in touch with is a standard setting made by a bona fide house organization and that represented the newest people involved courtesy separate agencies.

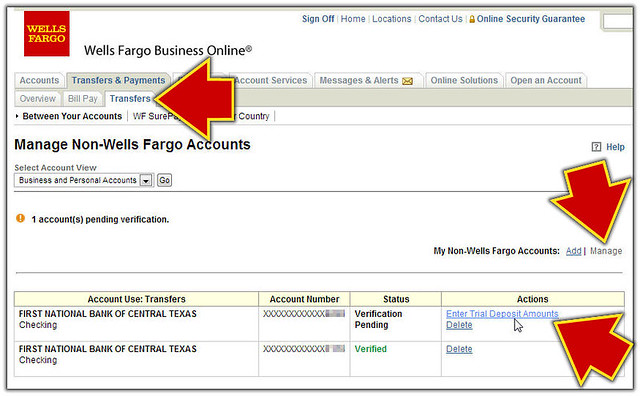

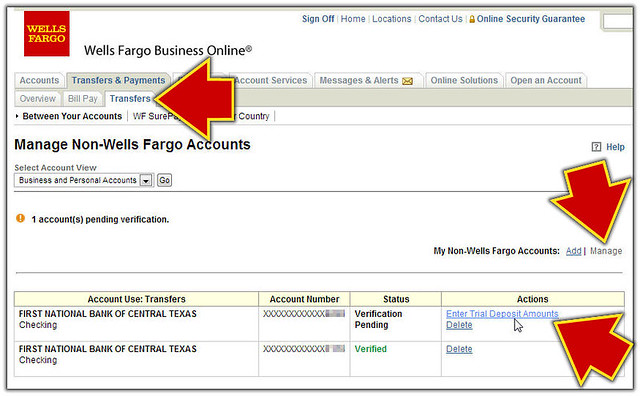

A commitment letter could be sent for you by your Financial Professional, just after an appraisal report has been examined by Financial

Term 6 of your deal contains a provision named Financial Contingency. Based on Clause 6, [t]the guy Buyer’s obligation to do which deal relies on the buyer bringing paydayloanalabama.com/baileyton a created union out-of an established home loan company, and/or Vendor, while the case is, and make an initial mortgage loan on assets regarding principal amount of $ 532,. . . . The customer shall likewise have all the necessary data and you will costs wanted from the financial.ادامه خواندن