Choice 2: Investing in Collateral and you may Shared Financing Experts away from Investing in Equity and you can Common Finance step 1. Prospect of High Yields

Investing common financing, specifically by way of SIPs, makes you gain benefit from the power of compounding over the lasting.

Partial Prepayment and you may Spending Prepay Part of the Mortgage Have fun with a great part of the free financing to own prepayment to attenuate the mortgage load.

These money purchase holds of numerous enterprises, providing highest efficiency that have reasonable to help you high-risk. He’s right for enough time-name specifications.

Such loans spend money on fixed-income bonds, providing steady returns that have lower risk compared to the collateral money. He’s suitable for quick to medium-term wants.

This type of finance put money into both equity and loans tools, bringing a well-balanced method of risk and you may come back. They are right for people seeking average output that have healthy exposure.

Latest Skills Balancing ranging from paying down your house financing and increasing their assets is essential

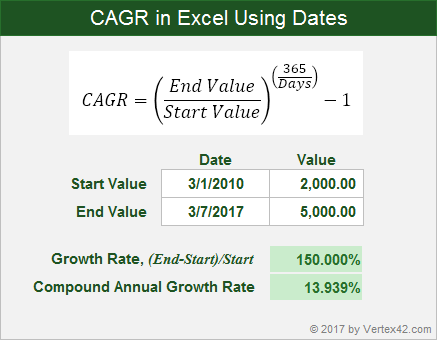

Fuel regarding Compounding The efficacy of compounding works best that have mutual fund. The interest attained will get reinvested, causing rapid growth through the years.

Prepay the main loan

Part prepayment and you may expenses. If you take other people in the security and you can shared finance. Because of the contrasting your financial wants and risk tolerance, you may make an informed choice.

Ans: Researching Debt Method Current financial climate Month-to-month Earnings: Rs 1 Lakh Financial: Rs forty-five Lakh having an EMI out-of Rs 37,000 Mutual Money Assets: Rs 56 Lakh PPF Financial investments: Rs 15 Lakh Emergency Finance: Rs six Lakh for the FD and fifty gm SGB Month-to-month Drink inside the Guarantee: Rs 31,000 Month-to-month Expenditures: Rs 30,000 – thirty-five,000 Insurance coverage: Identity Insurance coverage out of Rs dos Crore, Medical health insurance from Rs 25 Lakh Evaluating the home Mortgage Latest EMI: Rs 37,000, that’s 37% of one’s month-to-month money. Rates: Financial interest rates usually are down than the collateral production. Recommendation: If at all possible, continue with your own SIPs and you may emergency finance whenever you are controlling the EMI. Impact out-of Breaking Investment Mutual Financing: Breaking these may impression your own long-name riches buildup considering the loss of compounding positives. PPF: This is exactly a lengthy-name, low-exposure funding. Withdrawing it might not be top. Recommendation: Avoid breaking financial investments unless it is crucial for financial stability. Future Desires and you will Think Kids’ Knowledge: Concentrating on Rs fifty Lakh in fifteen years. Advancing years Corpus: Targeting Rs six Crore. Investment Strategy for Degree:

Remain committing to security mutual funds and you will SIPs. Consider increasing Sip wide variety since money expands or expenses dump. Investment Strategy for Old-age:

Typical opportunities into the common finance that have an effective diversified portfolio. Include guarantee having progress and you will debt to possess stability. installment loans online VA Emergency Loans and Liquidity Current Emergency Financing: Rs 6 Lakh is a good begin. Recommendation: Care for so it financing to fund unexpected expenses. Imagine growing it your income increases. Insurance Name Insurance rates: Enough publicity which have Rs 2 Crore. Health insurance: Rs twenty five Lakh publicity is right, but make sure they match all nearest and dearest means. Financial Method Moving on Look after Assets: Carry on with their shared loans and you can SIPs to benefit out of compounding. Raise SIPs: As your finances advances, boost SIPs getting most readily useful buildup. Opinion Continuously: Frequently assess and to switch disregard the and you may economic procedures having a beneficial formal monetary coordinator. Avoid cracking your expenditures except if absolutely necessary. Run keeping and you may increasing your SIPs and maintain a strong emergency financing. Regularly opinion your financial specifications and methods to stay on the right track.

Insights Your existing Condition You really have a home loan from Rs 49 lakhs with a great 15-12 months tenure. You finished 1 year, plus EMI is actually Rs forty eight,3 hundred. You really have Rs dos lakhs now available and will free a keen extra Rs 30,000 a month.