Period of Current Offer

Those with quick-title agreements may find it tough to safe a mortgage off traditional lenders, as there try a more impressive exposure connected to money for those instead of protected long-title a position. Lenders may wish to understand the big date left required on your most recent deal ahead of it imagine you having a mortgage. This will are different between lenders ranging from step three and you will 1 year.

Regular renewals of your own package usually prompt lenders, which makes them expected to envision your when you have simply two months left on the current deal. In addition, written verification of a restoration of bargain create remind loan providers to adopt you although discover zero days leftover during the your existing reputation.

Breaks from inside the Employment

Trips into the employment may cause problems to have lenders as they need to remember that you have an established and you can uniform money to purchase month-to-month mortgage payments.

You may be ineligible which includes financial institutions if you have got a work gap over the past one year. However, almost every other loan providers might have less strict constraints, providing you features a renewable income.

Also, the phrase exactly what constitutes a space when you look at the a career can differ between lenders. Particular could possibly get imagine merely one times to-be some slack in a job that apply to the mortgage alternatives. Most other lenders will get accept a space out of 4 weeks anywhere between deals, so long as discover an acceptable factor.

Even though the a long work on out of normal a career is much more preferred by mortgage organization, this is not impractical to rating a mortgage with breaks inside their a job background.

Get in touch with a home loan mentor who’s entry to the whole market. They are able to suit your affairs into qualification requirements out of home loan company.

How much cash normally Brief Pros Use?

When you yourself have a beneficial a job history, and no gaps and you may an agreement you to definitely continues to have an extended name commit, you will find a good possibility to secure an excellent 95% mortgage or over to help you 5x your revenue. Although not, in the event the you will find holes between the agreements, you will need a bigger deposit.

If you find yourself a temporary payday loan in Horn Hill AL staff, there are certain steps you can take to switch your odds of getting home financing bring. It are:

- Prove Your income Provide payslips over the past seasons, in addition to a few prior P60 variations or taxation statements.

- Inform you Balance Indicating a loan provider which you have held it’s place in an identical line regarding short term work for more than 12 months tend to considerably enhance your possibility of being acknowledged.

- Provide Bank Statements This may let you know loan providers your earnings and you may outgoings, that can be used to decide if you have the called for throw away earnings having home loan repayments.

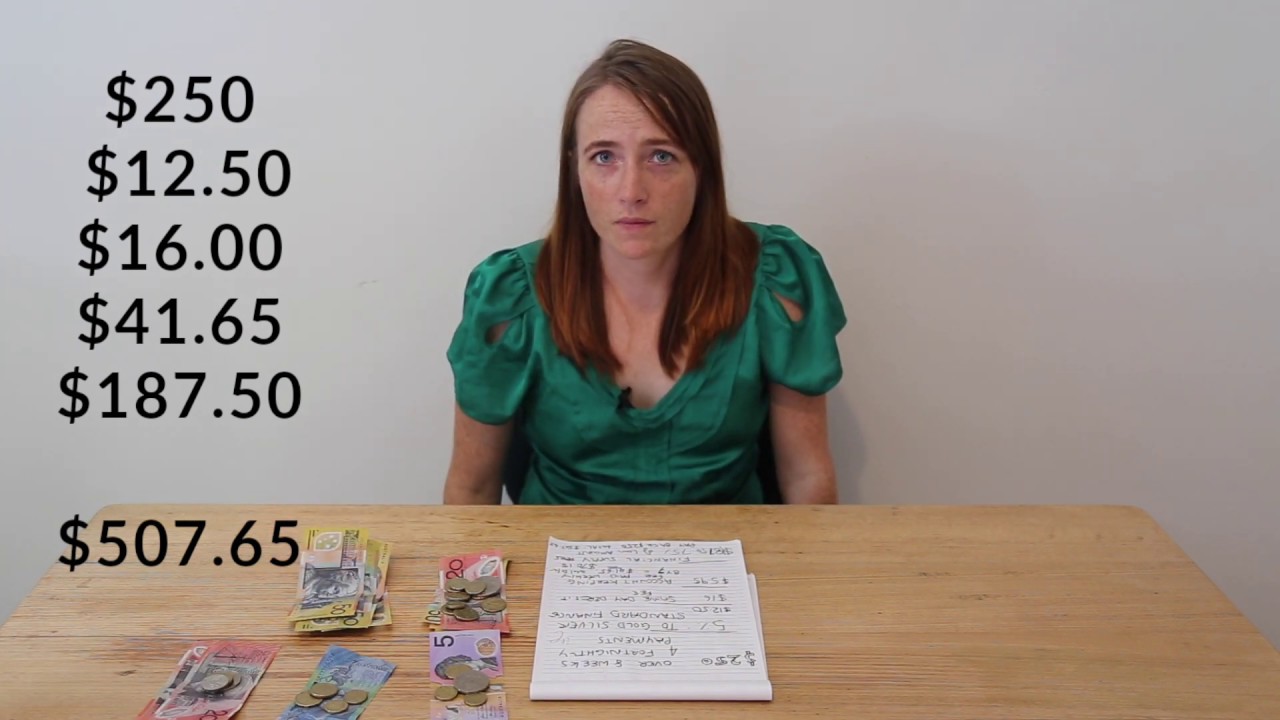

- Alter your Credit rating This can be done in certain different ways, including repaying the balance of every credit cards, build bill repayments timely, and don’t make an application for multiple mortgage loans without speaking with a mentor to end several enquiries.

- Collect as much a deposit that you can More substantial put enables improve your possibility of taking a mortgage because a loan provider takes into account so it since less chance. Usually, the higher the newest deposit, the low the chance.

Mortgage to the a fixed-Label Bargain Head Takeaways:

- Repaired package and agencies gurus is safe a mortgage.

- Loan providers will look a whole lot more favorably towards the temporary pros no holes in their a career history and you may protected work in the long run.

- Home loan providers will have stronger qualifications conditions for those inside short-term employment.