Of a lot Florida homebuyers today are trying to find a limited down-payment financing service. The cash loans Fruitvale Colorado new FHA mortgage however remain on the big alternatives for family people that have less than 20% deposit. Understanding the FHA financing recognition processes is essential for those who thinking about bringing an FHA home loan soon. This new FHA is a federal government business one to guarantees domestic mortgage loans produced by loan providers. The apps can be very helpful to possible people through providing restricted off costs as low as step 3.5% down.

If you’re to shop for a property with well over five systems, you will not be considered within the FHA home loan program

To incorporate and commence your FHA application for the loan, you’ll have to to locate an approved FHA lender. New FHA does not indeed develop people money and this, relies on normal banks and mortgage brokers to write the financing for them. The us government merely backs and you will insure this type of mortgages. Thus you need to be able to find several FHA loan providers towards you. Most financial institutions work on the fresh new FHA in a few potential. We can certainly assist Florida homeowners, simply label 800-743-7556.

The initial step along the way try pre-certification, or pre approval process. This task relates to you talking-to the financial institution regarding your problem and receiving pre-accredited. With this action, they gather factual statements about your own houses records, job history, income and you may debts. They will certainly upcoming make you a standard thought of just how much currency you may be able to obtain. The program techniques needs you to provide them with much off personal data. Might need to know all about both you and the money you owe. You’ll provide them with your term, address, public security count, information about the money you owe, and you can anything else which they request.

After you apply for the borrowed funds, and now have a contract buying property, the financial institution will procedure your own financial. They improve your credit history, ensure your income and your a job state. They are going to consider all account you have and your complete loans. They’re going to play with debt-to-money ratios to choose for individuals who fulfill their borrower guidance. With this action, they’re going to know if you have to pay their bills on time, if you make sufficient currency to the financing you are requesting, and a great amount of other information.

The lending company will likely then need certainly to appraise our house and make certain that they are able to lend up against they. They dispatch a keen appraiser commit go through the household put together a regard.

Up to now, in the event that what you looks good, they will post the loan to underwriting. This is like a last view so as that the brand new financing is suitable. Either the lender usually request extra files now.

The lending company often revision all needed paperwork during the time

When the everything happens better around this point, they will certainly then schedule a closing. Might sit-in the new closing, sign multiple paperwork and then the financial and you may marketing of your own house might be finished.

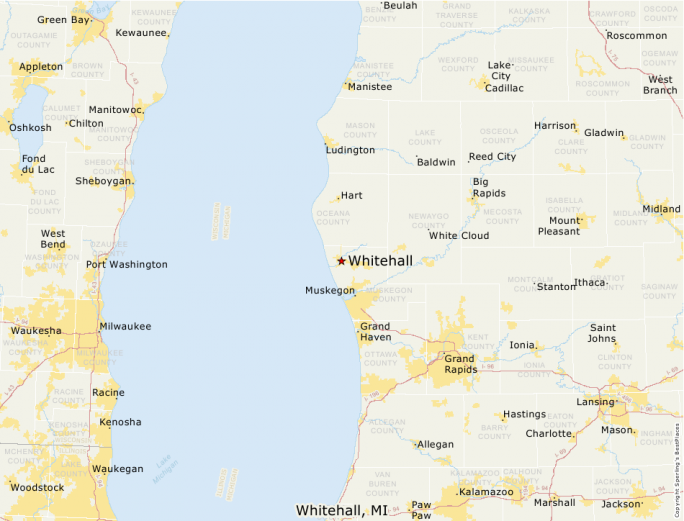

The new restrict is decided on a region-by-condition base in this for each state. You can lookup limitations on your own certain area by pressing right here. . For every county have a summary of five ily house the method using a quad-home.

With the intention that you to be acknowledged to possess good FHA, really loan providers need a minute 640 credit history. FHA funds was flexible with respect to down-payment plus money, nonetheless do have minute criteria in terms of credit. If you have past negative credit history, you might still be considered so long as

- defaults and you may bankruptcies be more than just 3 years dated, and you will

- foreclosure be than simply five years old, and

- you don’t owe government entities people past-owed currency, as well as later fees, Or

- the score experienced a one-big date, negative state who has got because the already been fixed.

FHA Mortgage Source try Florida’s leading FHA mortgage money, providing your 7 days per week. Excite e mail us today to find out more.