In today’s digital decades, it’s very easy for their major records going not as much as your hands out of a keen unauthorized organization , and that means you must be more careful if your handling your own on line purchases.. Be certain that to keep your usernames and passwords as well as avoid online cons. And the 2nd treatment for do this is via reducing the experience of the https://clickcashadvance.com/loans/no-credit-check-installment-loans/ latest unauthorized and you can third party other sites. Bringing your personal information just like your mastercard number and you may pins via email address or any other online typical is a thing that you should stop intrinsically. Together with, changing your web banking and you may bank card passwords frequently is essential. Most of the deals going on during your phone otherwise pc, it is important to shop your own passwords securely.

Finding problems on your credit file instance replication out of borrowing from the bank purchases, or completely wrong information that is personal, is going to be repaired for the very first. You should also improve the disagreement towards respective borrowing from the bank bureau and will resolve the mistake in the earliest possible bring down your credit rating.

Notification of one’s Borrowing from the bank Expenses:

Brand new smaller you reach find out about your own borrowing from the bank purchases, that’s on how best to do it if there is con otherwise a discrepancy.Grab tips to focus on the credit rating to carry they around the 850 draw. If it’s not on the most useful position as you are able to make by paying costs timely, limiting credit publicity, maybe not closing dated account, perhaps not delivering numerous credit at once, makes it possible to improve your credit rating. Very, your credit score you should never change straight away therefore takes time and effort to acquire a healthy credit rating.

Why you ought to Display your credit score?

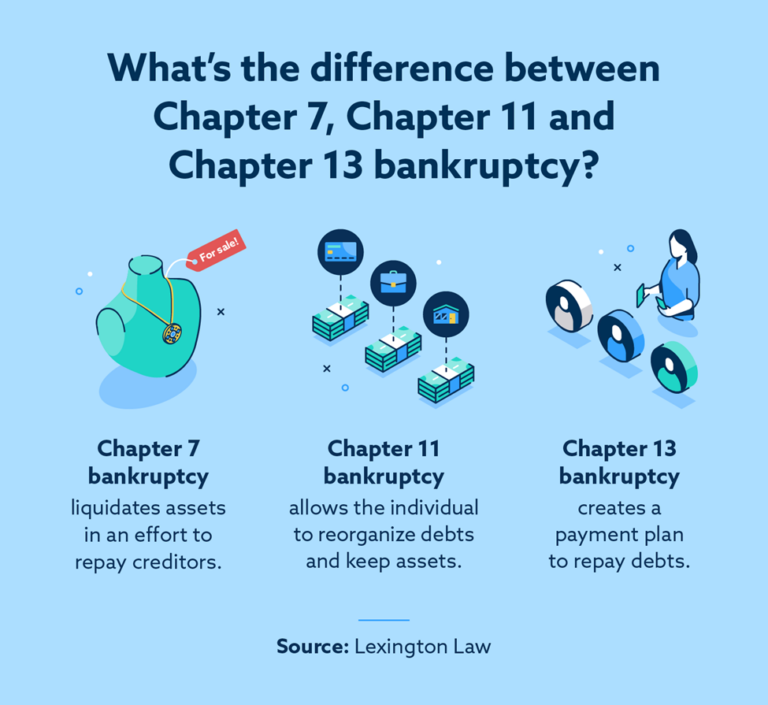

Credit score are a record of your ability to repay your costs along with your way of duty is additionally showed . It’s always mentioned and you will submitted on the credit file you to entails the amount and you may version of your borrowing accounts, and additionally for how enough time for every single account could have been unlock, amounts owed, the amount of readily available borrowing from the bank used, if expense try paid down timely, while the amount of present borrowing from the bank issues. And your credit history consists of factual statements about when you yourself have one bankruptcies, liens, selections, otherwise judgments.

Youre considering protected use of your credit history and are also qualified to receive one to totally free credit file of for every single borrowing from the bank agency to the a yearly basis. It could be accessed off people regulators-accepted web site.

Constantly , the information on your credit score establishes whether or not to offer credit for your requirements. All the info on your own credit score as well as exercise their FICO get. The brand new financial institutions feedback your credit history. There are even different aspects: latest activity, how long that borrowing levels was indeed open and you can energetic, also the models and you will regularity away from payment over stretched attacks of energy.

The term that’s primarily used regarding borrowing card transactions try credit rating. ?Which get is actually ranging from 3 hundred in order to 900 and you may a score above 760 is considered to be good. A healthy credit score is a sign of your own credit worthiness. One another a credit rating and credit report be otherwise smaller a similar organization however, a credit file is actually a beneficial absi;utre standalone document.

So, your with good credit records are noticed getting safer with regards to paying bills and hence discover loans quite easily. It credit history is derived from a certain formula and you may forecasts future of the latest your financial balances

As a customer in addition normally look at the credit rating from the procuring your credit score. But not, you will have to affect any one of the around three credit rating enterprises when you look at the Asia – Equifax, Experian, CRIF or CIBIL. Basically, CIBIL and you may Experian may be the very searched for bureaus because of the reality that they are most useful as well as the oldest credit suggestions bureaus within the Asia. It report will get details about the loan relevant purchases with each other with every mastercard membership they own had otherwise possess currently. For the effortless terminology, they shows your financial record. According to the recommendations given regarding credit file, your credit score are determined.