Danielle Keech

It’s really no magic our to your-the-go armed forces existence has the benefit of united states generous possible opportunity to buy real estate. We flow all of the lifetime, and every relocation necessitates the way to issue, do i need to buy otherwise lease a house?

When the purchasing is the answer, the procedure you will getting a tiny overwhelming. People quicker used to the process may easily wander off inside the actual property slang while the, in the external, almost everything appears the same. Grab mortgage pre-certification and mortgage pre-approval, eg. For each identifies a home loan, what also search a comparable, however, despite its common core, he’s quite definitely several separate anything.

Starting point: Organization

Before we obtain to your these subject areas, let’s mention monetary providers. To own often pre-qualification and you may pre-acceptance to have one relevance, your financial files has to be manageable. You will have to express over details about your debt, property, income, as well as the newest position of the credit.

Here is what you need:

- A summary of your current debt, such as for example charge card balance.

- A list of their possessions, such as your Honda or Harley.

- Proof your revenue, like your Exit and you may Getting Statement (LES) from your own army MyPay account.

What exactly is a home loan pre-qualification?

Financial pre-certification is the 1st step of one’s procedure, and it’ll make you a concept of how much money you could potentially qualify for in your mortgage. It guess is founded on customers considering suggestions, instead of facts inspections. It’s mainly around on how to imagine as you put a good househunting funds, not to ever provide the impetus to put in a deal on your own dream house.

Nowadays, it’s easy to complete a mortgage pre-degree on the web or higher the phone-this may give you a primary guess from exactly how much $800 loan today Hartselle AL household you can buy.

Here’s what we provide with loan pre-qualification:

- It’s small, always inside 2-3 days.

- It does not were a diagnosis off credit history.

- It’s oriented only for the suggestions brand new debtor gets the bank.

- It is far from a pledge of the pre-approval matter.

That have a quick overview of the membership, you get a good ballpark contour to own a possible mortgage, which can help paint an image for your house to invest in budget. Out of this, you will be aware should your timing is right for you to spend when you look at the a residential property. Maybe your money are not in which they need to be-that’s ok! Now’s the time to take one step back and check the picture as a whole.

Think about, so it initially remark verifies as possible be able to get an excellent domestic and just how far domestic you could probably buy. It is not similar to that have pre-recognition to own a mortgage.

What is actually a home loan pre-acceptance?

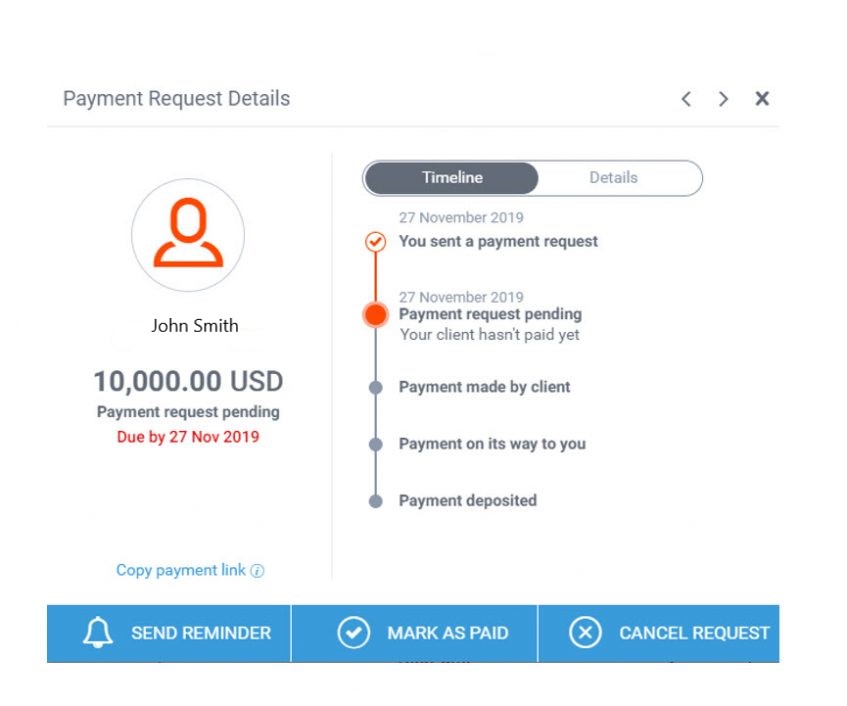

Just after searching your pre-qualification, it’s a very good time in order to re also-take a look at your wide variety. Up to now, are you confident in your credit score or the debt-to-money ratio? If you think comfortable in the to shop for a home, possible go on to the next step, which is making an application for a mortgage. In lieu of the latest pre-certification, this action relates to an extensive monetary record and you may credit score assessment and you may range from a software payment.

Some tips about what this new pre-recognition lies in:

- A completed financial app.

- Your credit history.

Considering this informative article, the financial institution is then in a position to offer a great certain amount that you are acknowledged so you can use, in addition to mortgage loan. A statement out of pre-acceptance mode more than becoming pre-qualified. Which have pre-acceptance, a prospective family visitors now has a beneficial conditional commitment having a keen right amount borrowed. That is what you want accompanying the offer on that fantasy home you got their eye towards.

Having an excellent pre-recognition page ready and you may wishing can supply you with an advantage whenever considering looking for a house. From inside the an aggressive seller’s business when there are bidding battles and you will most most other consumers competing for the very same possessions, evidence to spend the money for home could well be cause adequate to suit your promote to go up to the top. Or can you imagine, instance, that house vendor is actually pressed to have date prior to a pcs circulate (one to never ever takes place in army lifestyle, proper?). With your resource currently in line, they are going to see you may be a yes topic.

“By getting a good pre-approval out-of a lender, you really know for sure the amount of money you is also count on, or in other words, exactly how much you could potentially obtain. After you discovered their pre-recognition away from all of us, all else will come far more easy, as you already know just what you are searching for.”

Very besides if the process flow a tiny quicker, but your bank is not going to go back and reduce the borrowing from the bank matter, untrue which have a potential family consumer who’s only already been pre-qualified. Within this situation, your own pre-recognized provide is exactly what that loved ones has to intimate to your their house profit ahead of they hit the road to their brand new task.

The conclusion? Confirming home loan pre-recognition delivers that you’re a serious customer happy to lay an bring rapidly. This might place the quote apart if an aggressive provide have a delay into the resource.

“You need to have an excellent pre-approval, and it also have to be a genuine pre-recognition that lender has actually confirmed, not simply the borrowing from the bank however, lender comments and tax returns- I name the financial institution to confirm you to definitely.”

Why don’t we recap: Pre-degree is learning how far you could purchase regarding a standard guess. Pre-acceptance regarding a lender is exactly what you will want prior to place an render with the a home.

All in all, the greater wishing youre for choosing a property, the easier it will be to navigate a deal. When you’re ready to start your property seem, check out the house web page locate your next domestic. Before long, you will end up paying with the household you have been fantasizing out of!