Plans out of revenue fundamentally consist of a laundry list of contingencies hence should be came across through to the payment day. Most, if not completely, ones contingencies allow the customer to flee off an otherwise bad a property exchange.

From inside the Watson v. Gerace, the us Courtroom from Is attractive to the 3rd Routine recently avoided residents of exploiting home financing contingency term present in an enthusiastic agreement from income.

J. Scott Watson and you will Laura Watson, exactly who had the second floor flat during the an effective duplex during the Ocean Town, Nj-new jersey, conducted a composed arrangement to offer the apartment to Joseph and Donna Gerace to possess $665,000.

The newest get in touch with is a standard setting made by a bona fide house organization and that represented the newest people involved courtesy separate agencies.

A commitment letter could be sent for you by your Financial Professional, just after an appraisal report has been examined by Financial

Term 6 of your deal contains a provision named Financial Contingency. Based on Clause 6, [t]the guy Buyer’s obligation to do which deal relies on the buyer bringing paydayloanalabama.com/baileyton a created union out-of an established home loan company, and/or Vendor, while the case is, and make an initial mortgage loan on assets regarding principal amount of $ 532,. . . . The customer shall likewise have all the necessary data and you will costs wanted from the financial. The newest relationship should be obtained by Consumer for the or prior to . . . . If the customer perhaps not have the created connection from the significantly more than time upcoming which Offer are going to be null and gap and all of put money will be returned to the customer; unless of course the fresh new relationship go out was prolonged by Visitors and Merchant. The buyer, within his option, is also waive that it home loan backup anytime. . . . One home loan union signed of the Customer commonly meet that it home loan backup.

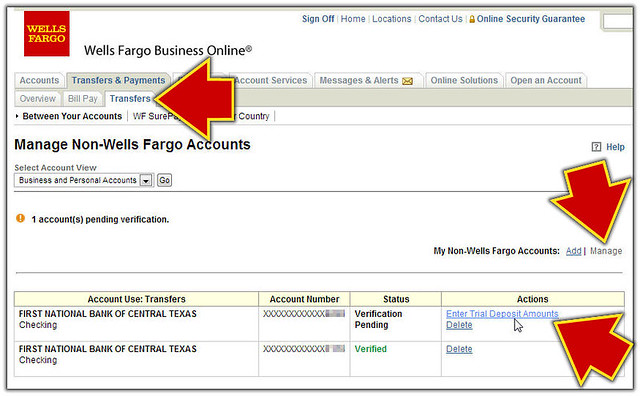

Into , brand new Geraces obtained good Credit Recognition Letter from Wells Fargo Mortgage, which they finalized to the . New letter mentioned Done well! Your loan software has been recognized susceptible to the words and you can criteria provided about this borrowing acceptance letter.

The new page contains plenty of conditions, including: a confirmation of your own Geraces’ financial status; an assessment of the house exhibiting a market worth of the decided purchase price; and documentation approving an extra home loan away from $33,250.

Underneath the terms of the fresh price, new Geraces placed $fifteen,000 when you look at the escrow and you will offered to afford the harmony having cash and you may good $532,000 home loan

For the , the new Watsons contacted its representative to inquire about the newest condition away from the mortgage commitment. They informed him to share with this new Geraces that package perform be considered null and you can void until the brand new union was received by the him. A day later, the fresh representative faxed a copy of the Borrowing from the bank Approval Letter to this new Watsons. Afterwards, the brand new Watsons reported that the fresh letter are unsuitable on it and you may that the package is actually null and you will emptiness. Then they questioned you to its agent re-number the house for sale.

The newest Geraces however searched in the originally arranged closing. The fresh Watsons, in place of searching within closing by themselves, registered an issue into the federal courtroom. In their ailment, they requested good declaratory wisdom that the bargain is actually null and you may void.

As a result, brand new Geraces filed a hobby on the Premium Legal of the latest Jersey to own breach out-of deal, asking for injuries and you can particular abilities. The official court case is actually at some point got rid of so you can federal judge and you can consolidated with the Watsons’ declaratory wisdom action. Both parties ultimately gone getting summary wisdom. The fresh region legal provided bottom line wisdom on the Geraces generally to your the newest finding that the credit Recognition Page fulfilled the borrowed funds backup term.

Into the appeal, the third Routine kept the newest section court’s ruling strongly proclaiming that [i]t was a student in creating, it was obtained from the Consumers till the due date, additionally the financing it approved fulfilled the mentioned monetary requirements.