In many ways, they are. Whatsoever, most credit unions and you can banking institutions provide similar services. The application form processes is going to be about the same and you can accessibility brand new organizations on the internet and from the physical towns and cities is additionally equivalent.

Here’s what you need to know regarding the finance companies, borrowing from the bank unions, and the ways to make best choice to suit your money:

Significant Variations: Banks compared to Credit Unions

The major variation would be the fact banking companies are generally buyer-possessed and-funds. Borrowing from the bank unions are controlled and you may owned by its players. A new major distinction is that borrowing from the bank unions come back profits so you’re able to participants when it comes to all the way down rates, quicker costs, and. Financial institutions spend its payouts out over investors.

How Borrowing from the bank Unions Functions

Credit unions are not-for-earnings financial agencies which might be completely owned by their members. It drink places, provide economic functions, and you can form similar to a lender. But they aren’t federally taxed eg banks, plus they are entirely treated and you will funded by credit commitment players.

Borrowing unions usually have the prerequisites one which just end up being a good representative. Being a part, you may need to:

- Live-in a certain geographic city (urban area, county, county, etcetera.)

- Work with a particular career (such as for example knowledge)

- Work for a specific employer (hospital, etc.)

- Belong to specific communities (college teams, church teams, etcetera.)

- Possess a member of family that currently a cards commitment representative

You should keep a minimum quantity of registration shares of your own borrowing connection through to signing up for, typically for a moderate put regarding somewhere between $5 and you can $30.

Borrowing unions possess board participants who’re opted from the participants in the a great democratic process. This assures for every member’s voice is read. Board players willingly control the credit union and you will really works on and then make conclusion that benefit every participants.

The result is a beneficial collaborative build which have an effective build to enable them to doing the monetary requires. Such as for instance, user deposits are going to be loaned out over yet another affiliate as the a great mortgage, offering the debtor that have economic autonomy and you can an effective return to the fresh new depositor while the credit union.

Federally Covered Credit Unions

The newest National Borrowing Connection Display Insurance policies Fund (NCUSIF) assures government borrowing from the bank unions. A separate agencies called the Federal Borrowing Union Administration (NCUA) administers the latest NCUSIF. Thus giving government credit unions a similar insurance once the banks because of this new FDIC (Federal Deposit Insurance coverage Business). Eg FDIC-insured lender dumps, NCUSIF insurance hides to $250,000 into the deposits so you’re able to federal borrowing partnership accounts.

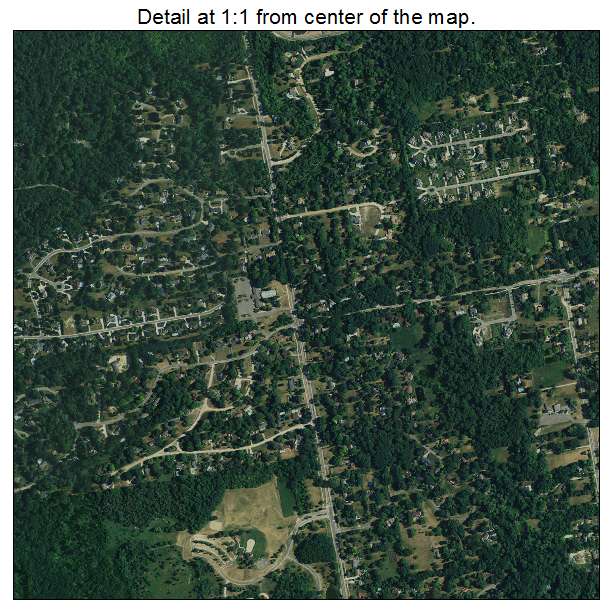

It’s easy to to acquire a national borrowing union in your area and put money into your financial upcoming by taking possession in your economic organization. To determine a national borrowing partnership:

- Pick authoritative NCUA signage . Government borrowing from the bank unions need certainly to screen cues indicating they are NCUA-insured after all twigs. You should look for signs near per teller channel and you will everywhere users are essential making dumps.

- Look at the site . NCUA signage must also show up on the website of any government borrowing relationship, together with regardless of where it has a choice for starting an account.

- Take a look at identity . Only government credit unions age.

Borrowing Union Rates compared to Financial Pricing

Of numerous perform believe banking is about acquiring the greatest rates. Just before we have toward prices assessment, keep in mind you to rates is just one of your own circumstances sensed when you compare financial possibilities.

Other kinds of charges, ideal support service choices and recognition techniques are just a few other variables you ought to contemplate. With that said, here is a glance at credit commitment cost versus. financial rates:

Basically, borrowing from the bank unions are recognized to offer all the way down loan rates and better offers rates. This can be perfect for whoever places currency otherwise borrows money. Higher savings prices bring about quicker economic development options. Down mortgage costs trigger currency paid off along side lifetime of funds.

Notice : Savings and you can funds costs out, borrowing from the bank unions save a little money in other parts. When compared with large payday loans West Jefferson loan providers, credit unions and charge smaller in the costs, require down minimal membership balance and provide ideal rates to your credit cards.

Versatile solutions, aggressive pricing

When it comes to credit, you can not overcome the lower-interest rates provided by a card connection. If you aren’t sure you’re saving of the going smaller than average regional, check out the NCUA’s writeup on average interest levels…

Diminished of a significant difference in the rates to really make the option to a cards partnership to suit your offers and you can lending means ?

For those who have less than excellent borrowing but you want financing, borrowing from the bank unions can often focus on people. If you find yourself thinking about obtaining a charge card, credit unions fees smaller inside the costs, give zero attract with the balance transfers and provide most incentives.

Begin making smarter economic decisions today!

During the Partners Monetary FCU, we’re here so you can reach your desires. More resources for all of our savings and you will financial loans, or even to learn how to subscribe People Monetary, e mail us today within 804-649-2957.